If you’ve got to grips with the basics of investing (which our previous articles should have helped with) you might be wondering whether you should spice things up with some different investments: enter alternative investments. We think of traditional investments as those that typically follow stock market trends, like shares, bonds and cash. But there’s a whole world of ‘alternative investments’ that range from watches to wine to cryptocurrency – so let’s get to know them better.

What are alternative investments?

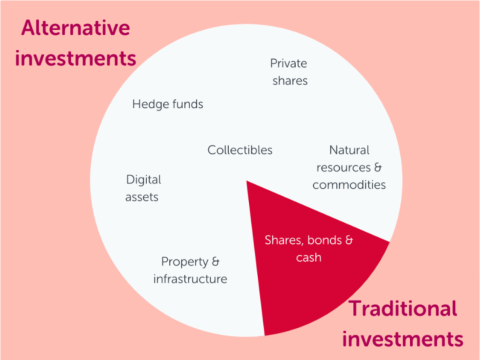

There are many definitions out there but one of the simplest comes from the fund manager, BlackRock. They describe alternative investments as “investments other than stocks, bonds and cash, or investments using strategies that go beyond traditional methods”.

But that leaves a big range of investments. On the one hand you have physical assets like property and commodities (oil and metals used to make the stuff we buy in shops), which have been traded for hundreds if not thousands of years. And on the other hand, alternatives cover cryptocurrencies and non-fungible tokens (NFTs) – ultramodern digital assets that have only emerged in the last decade or so.

Another slice of the alternative pie is collectibles. As you might suspect, these can be pretty much anything you can collect, from toys (think Beanie Babies and Barbies) to fine wines and classic cars. You name it, there’s an investment market out there for it, although many collectors would argue their value isn’t purely monetary.

Chart shown to illustrate wide variety of alternative investments compared to traditional investments.

How do they differ from traditional investments?

Alternative investments differ in many ways to their more traditional counterparts. Firstly, because most aren’t publicly traded on recognised stock exchanges, they aren’t as easy to buy and sell via investment platforms. They are relatively ‘illiquid’ – this means they’re harder buy, and as such, harder to shift when you decide to sell.

Then there’s the higher level of complexity and risk of alternatives. With any investment there’s a chance you could lose some or even all your money, but that risk is substantially higher here, especially if you don’t have professional knowledge or experience in the area.

Investments are like ice creams…

Here’s a delicious analogy to help you get to grips with the difference between traditional investments and alternatives. Imagine traditional investments – your shares, bonds and cash – as traditional ice cream flavours: chocolate, strawberry and vanilla. And the rest of the ice cream flavour universe – your pistachio, honeycomb and bubblegum – are your alternatives.

Though your traditional ‘flavours’ might not be the most exciting of options, you know what you’re getting, and they’ve a proven track record of performing (being delicious). While alternatives are always tempting, and you’ve heard great things, they carry more risk: they’re performance can be patchy and they could be all ‘style over substance’, potentially leading to some big disappointments.

Perhaps likening traditional and alternative investments to ice cream flavours is a touch irreverent, but who cares? It’s much more fun to think about the subject like this.

What's all the hype about?

According to Forbes Adviser, by the end of 2021 around £12.2 trillion was invested in alternatives (excluding collectibles) worldwide and this is projected to reach £20 trillion by 2026. It’s a growing market, and for many professional investors it forms a core part of their investment strategy due the different strengths they offer to traditional investments. Don’t get me wrong, pension funds aren’t busy investing in Barbie dolls or fine wines, but property and private company shares, for example, could help diversify a portfolio and ultimately improve its returns.

Away from the technical side of things, collectibles can appeal to more than just the investor in us. Some people might not even realise their favourite hobby or pastime could be worth some money one day. Here’s a personal example – my partner recently got back into Warhammer for pleasure not investment purposes, so it was a surprise to both of us when he came to sell some pieces on eBay that there is a huge second-hand market for the game. These alternative investments can often be bought for passion over profit.

There’s a mystique and heightened public interest around certain alternative investments. Yep, we’re talking about cryptocurrencies and the confusingly named, non-fungible tokens (NFTs). Their appeal is that they offer something different to the norm and we’ve all heard the stories about that mate of a mate (of a mate...) who made thousands on crypto. BUT. But for every story like that, there’s the opposite tale of huge losses. These investments are incredibly risky and, sadly, have landed many young and inexperienced investors in financial trouble. Let’s just say, we’re happy watching the development of these alternatives from a safe (and uninvested) distance.

Do AJ Bell or Dodl offer alternative investments?

Money Matter’s partner investment platforms, AJ Bell and Dodl, offer a wide range of investments to choose from but, due to their heightened level of risk, alternative investments don’t really feature heavily.

Dodl offers over 100 funds, exchange traded funds and shares, all of which would fit squarely into the box of traditional investments. While AJ Bell offers thousands of investments, most of which are traditional in nature, but some could be better described as sitting in a bit of a grey area. They include AIM shares for smaller, growing companies, exchange traded commodities or funds investing in property. These investments tend to appeal to the more experienced, and risk-taking of investors.

Remember that the value of investments can change, and you could lose money as well as make it. These articles are for information purposes only and are not a personal recommendation or advice.